Rate Lock Overview

Although they are a crucial part of the home buying process, mortgage rate locks can be complicated for first-time buyers. Everything you need to know about mortgage rate locks, including what they are, how they work, and when you can lock in your mortgage rate, will be covered in this article.

What is a Mortgage Rate Lock?

First, let’s start with the basics: what is a mortgage rate lock? Basically, a mortgage rate lock is a commitment from a lender to offer a specific mortgage rate to a borrower for a specific period of time. Mortgage interest rates change throughout the day. Sometimes those shifts can be large, making the cost of your mortgage vary from hour to hour. Your mortgage rate directly affects your monthly payment. A mortgage rate lock helps the borrower not to worry about the changing market by freezing that rate in time. That means if interest rates go up during their rate lock period, their rate and monthly payment stay the same.

What does Floating Mean?

Floating is the opposite of locking. It means choosing not to lock. Until you lock your rate, you are “floating” along with the mortgage rate market, whatever direction it goes.

How does a Mortgage Rate Lock Work?

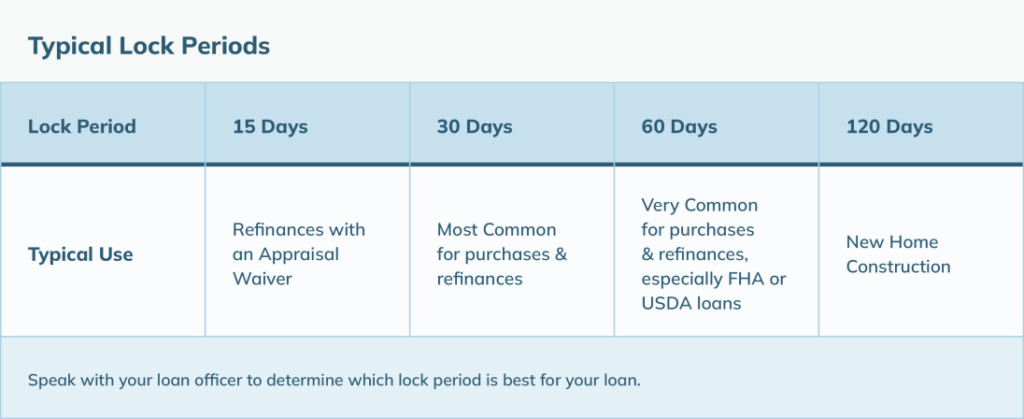

So, how does a mortgage rate lock work? When you apply for a mortgage, your lender will provide you with a list of mortgage rates that are available to you. You can then choose the rate that you want to lock in. Once you have chosen a rate, your lender will provide you with a mortgage rate lock agreement, which outlines the terms of the lock. This agreement will include the length of the lock (usually 30, 45, or 60 days), the mortgage rate that is being locked in, and any fees associated with the lock.

Mortgage Lock Fees

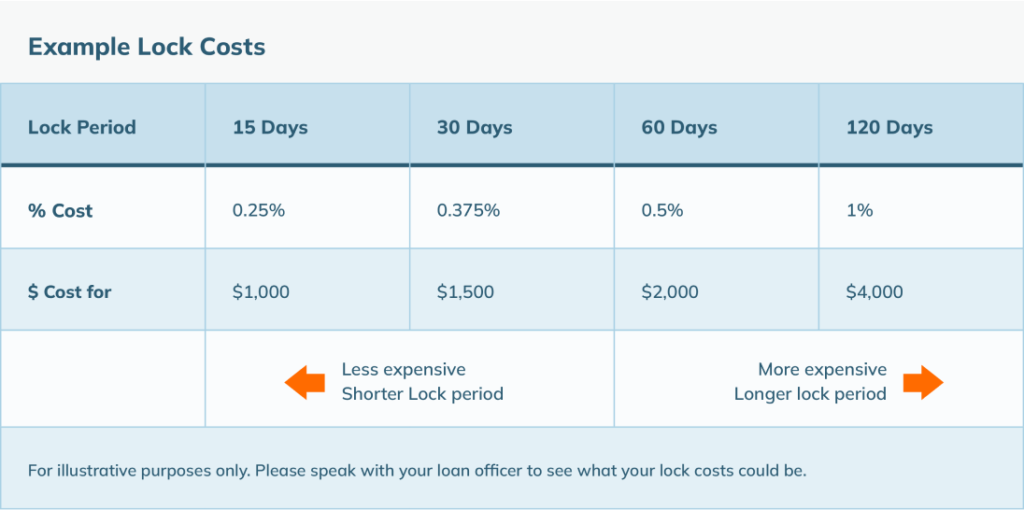

It’s important to note that mortgage rate locks are not always free. Lenders may charge a fee for a mortgage rate lock, which can vary based on the length of the lock and the market conditions. It’s important to review the terms of your mortgage rate lock agreement carefully and understand any fees that may be associated with it. In general, the longer the lock period, the higher the fee. These fees are usually a percentage of the loan amount, so if your loan amount increases your lock cost will increase too.

When can you Lock your Mortgage Rate?

Now that you know what a mortgage rate lock is and how it works, you may be wondering when you can lock in your mortgage rate.

Picking the best time to lock your mortgage rate can be tricky, because it involves the risk of the unknown. Interest rates go up and fall throughout the day. So you have to choose to lock at some point without completely knowing how rates will fluctuate up or down. Here are a few tips to help you decide when to lock in your mortgage rate:

- Monitor the market: Keep an eye on mortgage interest rates and watch for any trends that may indicate whether rates are likely to go up or down. Your loan officer is going to be your best resource on this.

- Consider your timeline: If you are in the early stages of the home buying process and have plenty of time before closing, you may want to wait to lock in your rate until closer to the closing date, but that can be risky. If rates drop, you can take advantage of any potential savings, but if rates rise, so does your monthly payment. If you lock, the bank is taking the risk.

Balance risk and reward: If you are worried about rates going up, you may want to lock in your rate sooner rather than later. This will give you the peace of mind that you know your monthly payment, as long as you close and fund before your rate lock expires. On the other hand, if you are comfortable taking on a bit of risk, and you think rates may fall, you can float (wait to lock). It all depends on what your appetite for risk is.

Mortgage backed securities drive the price of mortgage interest rates. If anyone could predict the price of MBS, they would be millionaires. So beware of loan officers that are 100% sure what rates will do.

Basically, humans are very risk averse, and as crazy as it sounds, you’re more likely to feel better about being locked and potentially lose a little, than not be locked and lose a lot.

What if Interest Rates Fall After you’ve Locked in?

If your rate is locked, and rates fall enough, you may be able to “float down” your mortgage rate. It is something that you or your loan officer have to request from the lender, but there are some limits on floating down. These limits differ by lender. So it’s important to note that floating down your mortgage rate may not always be possible, and it may come with additional “float down fees.” Since most lenders only allow one float down per loan, it’s important to rely on your loan officer to give you their best advice on when to float down.

When can I Lock in a Mortgage Interest Rate?

In general, the earliest you can lock in a mortgage interest rate is as soon as you have:

- Completed a full loan application and signed it

- Given your loan offer authorization to lock your loan

You cannot close your loan without locking your interest rate. The latest you can lock is a few days before closing.

How do Mortgage Rate Locks Work for Building a Home?

Many lenders offer extended lock periods specifically for building new homes. It’s common to see these from 120 days to 180 days (4-6 months). The longer the timeline, the more difficult it is to anticipate where rates will be, so the higher the rate lock fee will be. Home building timelines can vary from 6 months to years, so knowing you can afford the home at a range of interest rates is vital. The worst thing would be if rates increase to where you can’t actually qualify for the mortgage on your new home.

What happens if my rate lock expires before closing?

If your rate lock expires before closing, you will have to either pay a fee to extend the lock or accept the current market rate. Because costs for rate lock extensions can often change, it’s important to communicate with your lender and stay on top of your rate lock expiration date to avoid any potential issues.

Conclusion

In conclusion, mortgage rate locks are a valuable tool for borrowers looking to buy or refinance a home. They provide a sense of security by locking in a mortgage rate for a specific period of time, ensuring that you won’t have to worry about interest rates going up during the rate lock period. Rate locks are a required and normal part of every mortgage. If you have additional questions about rate locks that we haven’t covered here, please reach out to your loan officer.